Welcome to eBox Business Center and Printing Center

Your one-stop Business Center for Printing, Scanning, and Digital Services.

Have any questions for us?

Business Registration Services

Launching and maintaining a business can be a complex process, but we’re here to simplify it for you. Our suite of business registration services ensures that your business is compliant with local regulations and operational quickly

Business Center and Printing Center is a business concierge service focused on business registration, business compliance, and administrative services so that business owners can focus on the tasks that matter to them.

Registering your business gives you legitimacy in the marketplace and increases your credibility to customers. It also enables you to open a business bank account as banks only do business with registered entities.

The cost of registering your business depends on which type of business entity you’re interested in registering.

There are four (4) types of business entities: Sole Trader, Partnership, Limited Liability Company, and Non-Profit Organization. In choosing the business entity type best suited for you, you should consider the following factors:

- Purpose – What’s the purpose of the entity?

- Ownership – How many owners are there?

- Nature of Business – What activities will the business engage in?

We can have your business documents in hand within 48 Hours of you submitting your business information. Queries to your application may delay the process.

Yes, you can make changes to your business after it has been registered. You can change the business name, address, add/remove a partner, or director among other changes.

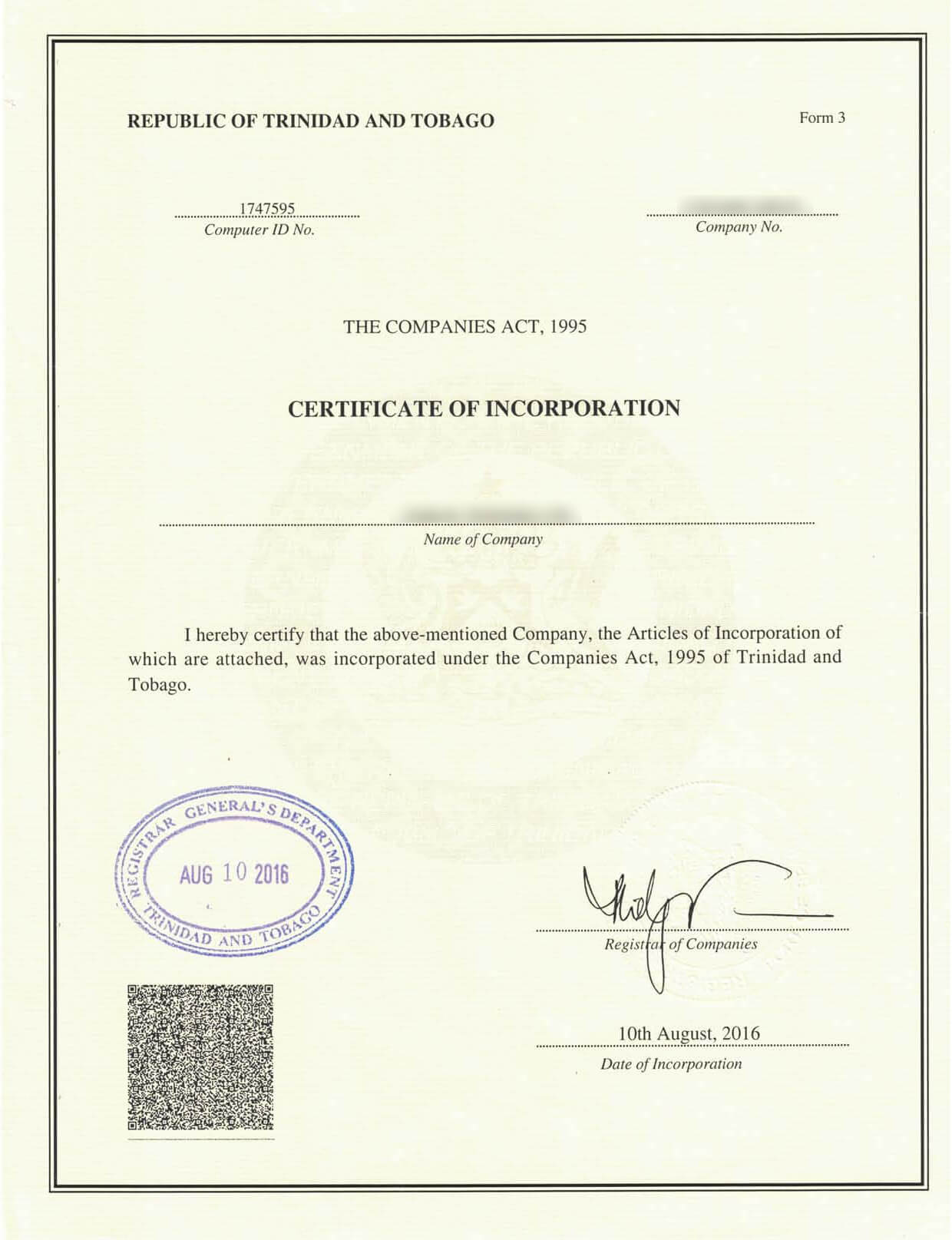

Simplify Your CROS (Companies Registry Online System) Registration

Ensure your business is officially recognized and compliant with the legal requirements in Trinidad and Tobago through our CROS Registration service. This platform allows for the seamless electronic submission of documents for company incorporation, business registration, and other legal filings. We guide you through the entire process, ensuring that your business meets all regulatory obligations efficiently and accurately. Let us take the complexity out of CROS registration so you can focus on growing your business.

- Birth Certificate

- Two Valid (2) Forms of ID’s with your full name

- Personal Email Address (NB: “Personal Email” must be different from “Business Email”)

- Business Email Address

- Headshot Photo of Individual Holding Their ID (NOT IN SELFIE MODE)

- Personal Phone Contact

- Business Phone Contact

- Utility Bill

- Marriage Certificate (if applicable)

- Nationality at Birth and Current Nationality

- Full Name and Any Former Names (NB: Deed poll or other documentation evidencing the change of name, if your name has changed.)

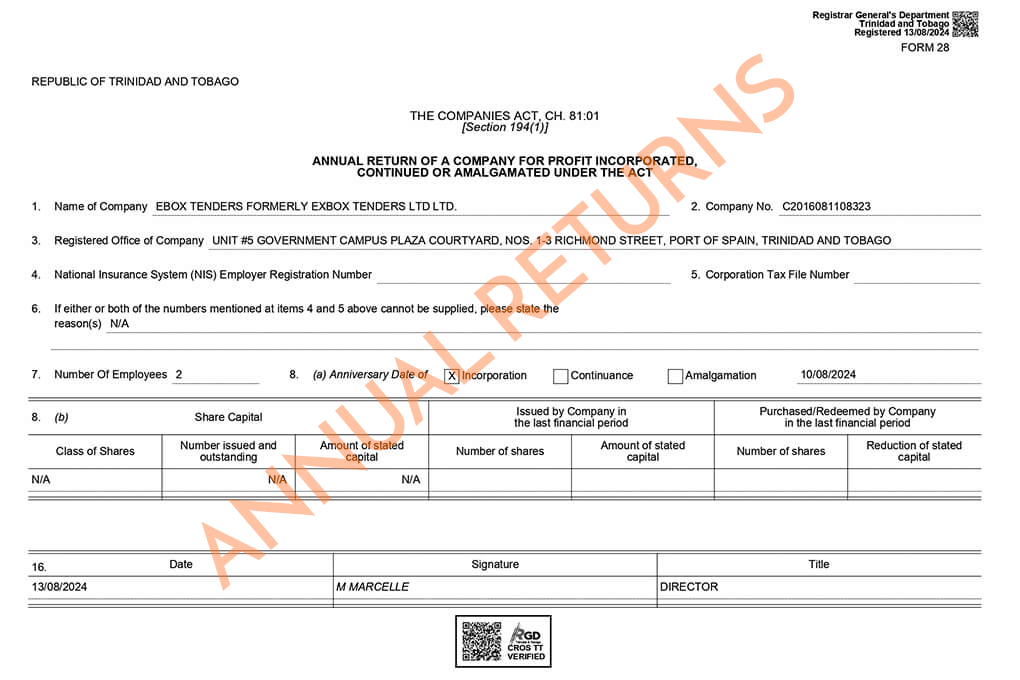

Stay Compliant with Our Annual Returns Service

Filing your Annual Returns is a critical step in maintaining your business’s good standing with the Companies Registry. Our service simplifies the process by ensuring your filings are accurate and submitted on time, preventing unnecessary penalties and keeping your business compliant with legal regulations. Whether you need a reminder or full filing support, we are here to handle the details so you can focus on running your business.

- Certificate of Incorporation

- Articles of Incorporation

- Notice of Directors

- Notice of Secretary

- Notice of Change of Address

- Forms 45 & 46

- Last Annual Return Filed (Optional)

- Director’s, Secretary’s, Shareholders’ and Beneficial Owners’ CROS Credentials

- Certificate of Incorporation

- Articles of Incorporation

- Shareholders’ share amount

- Shareholders’ and Beneficial Owners’ CROS Credentials

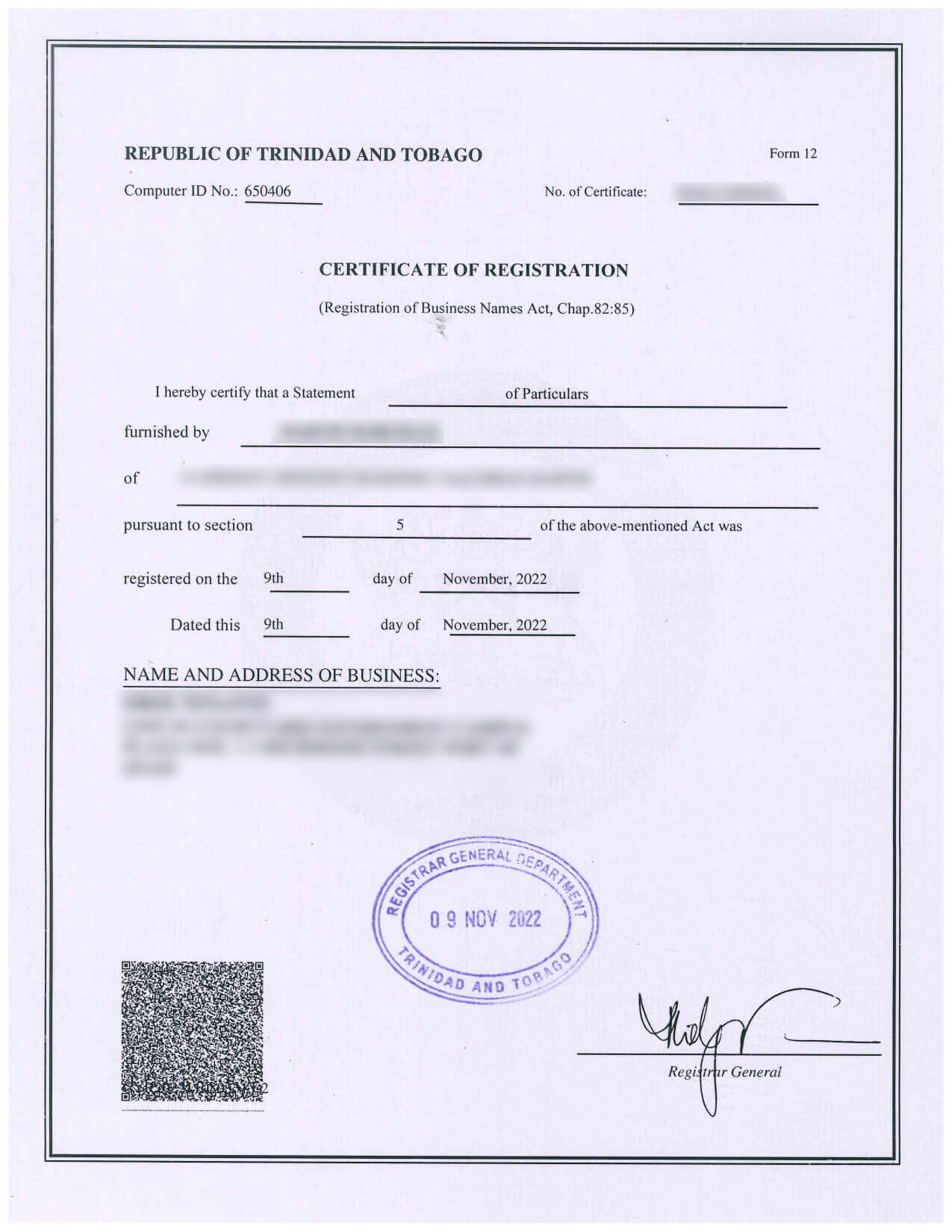

Streamline Your Public Procurement with OPR Registration

Our Office of Procurement Regulation (OPR) Registration service ensures your business is fully compliant with Public Procurement requirements in Trinidad and Tobago. By registering with the OPR, your company becomes eligible to participate in public sector tenders, opening up new opportunities for growth and success. We assist in preparing and submitting all necessary documents, making the process seamless and "hassle-free". Let us help you unlock the benefits of Public Procurement today!

OPR Registration Requirements

- Certificate of Registration

- Business Email Address

- Business Contact Information (Name, Address, IDs)

- NIB Registration Certificate

- VAT Registration Certificate

- Income Tax Clearance Certificate

- VAT Clearance Certificate

- Management Accounts

- Details of Past Contracts and References

- Bank Account Details

- Nature of Business [Line of Business]

- Organizational Chart

- Organizational Profile

- Licenses

- Insurance Policies

- Claims

- Legal History

- Largest Contract

- HSSE Policy

- Certificate of Incorporation

- Company Email Address

- Company Contact Information (Name, Address, IDs)

- Articles of Incorporation and Memorandum of Association

- Notice of Directors

- Annual Returns

- NIB Registration Certificate

- VAT Registration Certificate

- Income Tax Clearance Certificate

- VAT Clearance Certificate

- Financial Statements / Management Accounts

- Details of Past Contracts and References

- Bank Letter

- Nature of Business [Line of Business]

- Board Resolution

- Company Bye-Laws

- Principal Shareholders / Owners

- Beneficial Ownership (Forms 45 & 46)

- Organizational Chart

- Organizational Profile

- Licenses

- Insurance Policies

- Claims

- Legal History

- Largest Contract

- HSSE Policy

Visa Registration Services

Avoid the complications of visa applications with our professional services. We assist with the preparation and submission of visa applications for both the US and Canada, ensuring your application is accurate and complete for a smooth process.

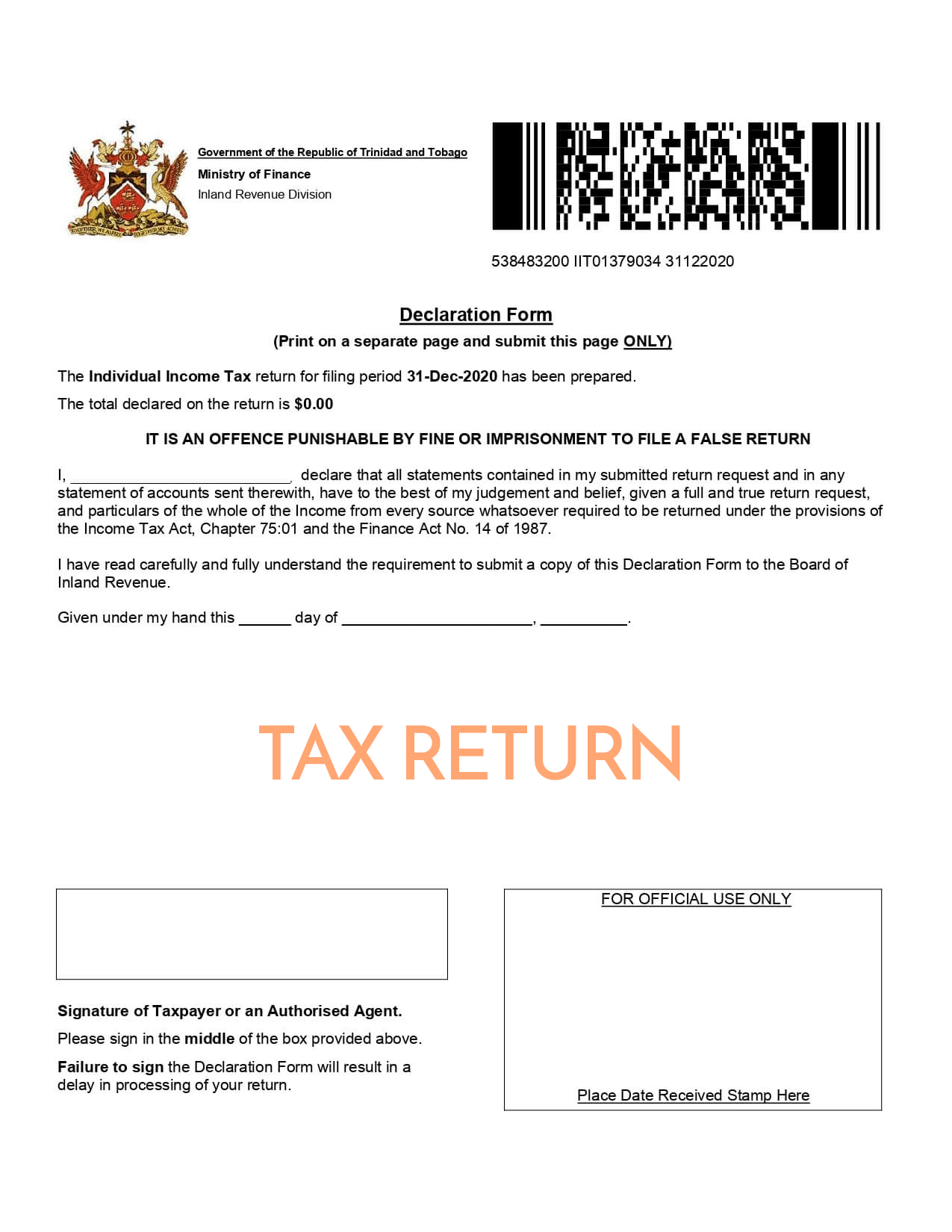

Taxation Services

Managing taxes can be daunting, but we simplify the process to ensure your filings are accurate and on time. Whether you need to file tax returns, get tax clearance certificates, or pay property taxes, our experienced team is here to assist you.

List of Tax Services:

- Individual / Sole Trader Income Tax

- Corporation Tax

- Property Tax

- Tax Clearance Certificates

- BIR Letter

- TD4 from Employer

- Income and Expenditure Statement (Sole Trader)

Tax Reliefs Available

1. Personal Allowance

- Individual Taxpayers: A personal allowance of $84,000 per year is available to all resident individuals. This means the first $84,000 of your annual income is not subject to tax.

2. National Insurance Contributions (NIS)

- Relief on NIS Contributions: NIS contributions made during the tax year are deductible from taxable income.

3. First-Time Homeowner Relief

- Mortgage Interest Relief: First-time homeowners can claim up to $30,000 per year in mortgage interest relief for the first five years of ownership.

4. Tertiary Education Expenses

- Education Relief: Up to $72,000 can be claimed for tuition expenses at approved institutions for tertiary education, applicable to the taxpayer, spouse, or children.

5. Alimony and Maintenance Payments

- Relief for Alimony Payments: Alimony or maintenance payments made under a court order may be deductible from taxable income.

6. Contributions to Approved Pension Plans and Retirement Annuities

- Retirement Savings Relief: Contributions to an approved pension plan, approved deferred annuity, or National Insurance Scheme are deductible, with a maximum combined deduction limit of $50,000 per year.

7. Investment in Venture Capital Companies

- Venture Capital Tax Credit: Relief is available for investments in approved venture capital companies.

8. Premiums Paid for Health Insurance

- Health Insurance Premium Relief: Up to $3,000 can be claimed for premiums paid for health insurance for the taxpayer, spouse, or children.

9. Donations to Charitable Organizations

- Charitable Donations Relief: Donations made to registered charitable organizations are deductible, up to a maximum of 25% of total income before allowing for charitable donations.

10. Capital Allowances for Sole Traders

- Wear and Tear Allowances: For machinery, plant, equipment, and vehicles used in the business.

- Initial and Annual Allowances: For capital expenditure on buildings and equipment used in the trade.

Business Center Services

We offer more than just internet access. Whether you need documents printed, appointments booked, or photos taken, our Business Center is fully equipped to handle your day-to-day administrative needs.

List Of Services:

- High-Speed Internet

- Photocopying / Printing

- Scanning

- Passport Appointments & Photos

- Stamps

- Police Certificate of Character Requests

- Immigration Extension Appointments

Our Process

Efficient & Meticulous

Select the service

your interested in

Fill out a questionnaire

to tell us all we need to know about

Sit back, relax

and allow us to do the actual process

Contact eBox Business Center

We are here to help with all your business, visa, tax, and Business Center needs. Feel free to get in touch with us or visit our location at Government Campus Plaza.